Article: Gone Rogue: The 5 Biggest Trading Scandals in Modern Finance

Gone Rogue: The 5 Biggest Trading Scandals in Modern Finance

In the electrifying world of finance, the line between glory and infamy is razor-thin. Welcome to the exhilarating realm of rogue traders, where brazen risk-taking, high-stakes gambles, and thrilling escapes converge into unforgettable stories. Fasten your seatbelts as we plunge into the five biggest rogue trading scandals in history.

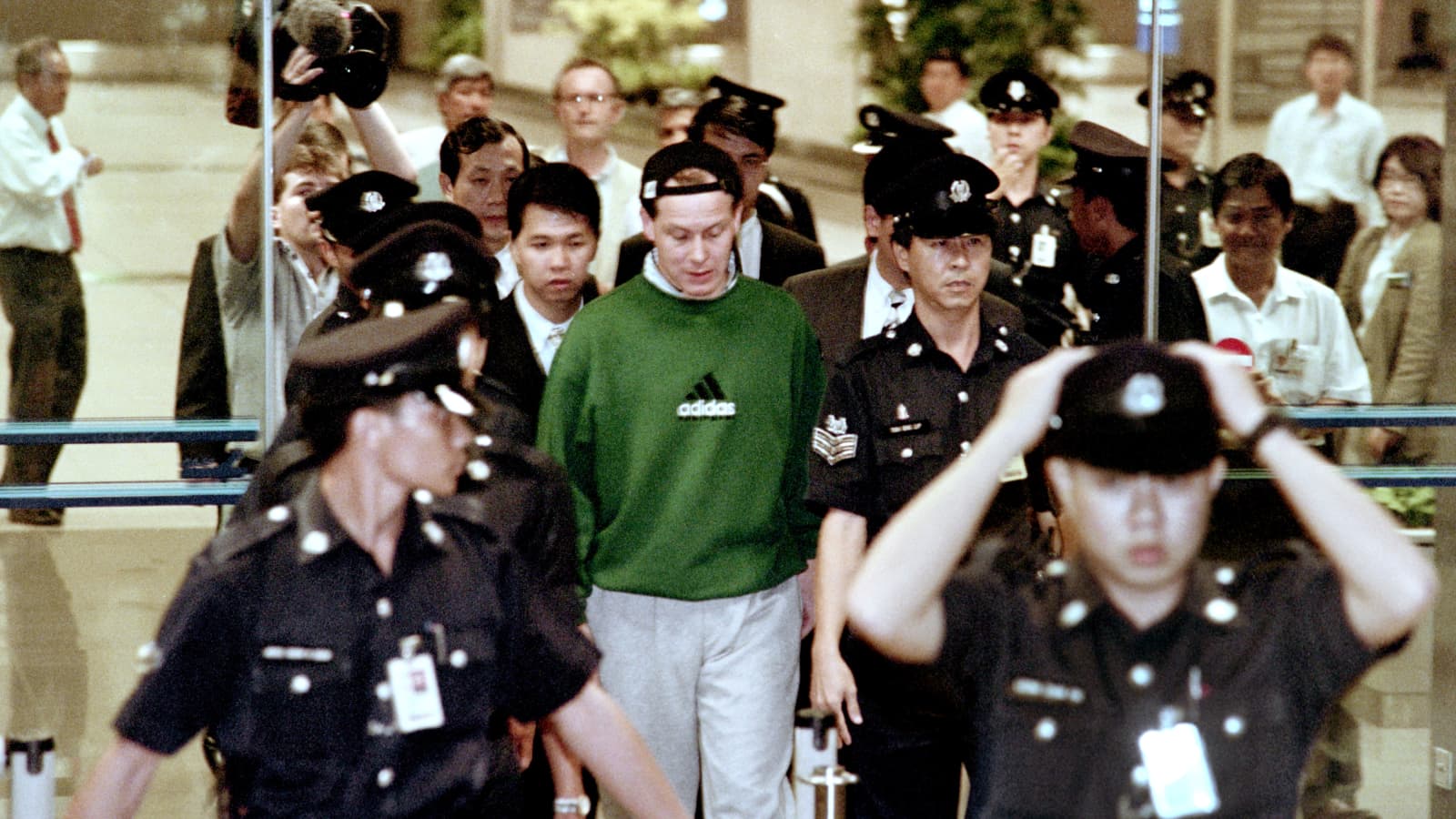

Nick Leeson - Barings Bank's Lone Deranger

Nick Leeson in the futures trading pit at Singapore's SIMEX

In 1995, Nick Leeson singlehandedly brought down Barings Bank, the UK's oldest merchant bank, with a staggering $1.4 billion in losses. At only 28 years, the rising trader shook the world when the extent of his unsanctioned trading of complex derivatives and futures contracts was exposed.

Leeson, the original 'rogue trader', created a secret trading account - Error Account 88888 - to conceal his unauthorized arbitrage strategies. He speculated heavily on the Japanese market's future movements, taking on massive, unhedged positions in Nikkei 225 futures and Japanese government bonds (JGBs). When the Kobe earthquake struck in 1995, the market took a nosedive, and Leeson scrambled to cover his mounting losses, only to dig a deeper hole.

Leeson fled Singapore, leaving a cryptic note, "I'm sorry", as his only farewell. He made a run for it, traversing across Asia and Europe, before being apprehended in Frankfurt. Leeson was extradited and served four years in a Singapore prison before being released due to his battle with cancer. Today, he's a motivational speaker and author, recounting his wild ride in the world of high-stakes finance.

Jérôme Kerviel - Société Générale's One-Man Wrecking Ball

Jerome Kerviel arrives at a Paris courthouse to face justice

Jerome Kerviel arrives at a Paris courthouse to face justice

In 2008, Jérôme Kerviel, a seemingly unremarkable trader at Société Générale, left the financial world gobsmacked with a jaw-dropping $6.7 billion in losses. The unassuming Frenchman, dubbed "the most indebted man on Earth," exploited his mastery of the bank's risk management systems to execute an elaborate scheme.

Kerviel, a master of deception, utilized his intimate knowledge of the bank's risk controls to forge documents and dodge alarms. He amassed colossal positions in European stock index futures, specifically the DAX, CAC, and EuroStoxx 50, betting the market would rise. Kerviel took advantage of "turbo warrants," complex financial instruments with a short lifespan, to make bets on market movements. When the global financial crisis struck, his house of cards collapsed, leaving Société Générale to bear the brunt of his risky bets.

When the ruse was exposed, Kerviel embarked on a 900-mile, headline-grabbing protest walk from Rome to Paris. Framing himself as a victim of a corrupt financial system, he sought public sympathy and even managed to secure an audience with the Pope. His journey ended at the French border, where he was arrested. After a high-profile trial, he was sentenced to five years in prison and ordered to pay back the entire $6.7 billion. However, Kerviel had become a cause célèbre in France and was released after serving just three years. The trader’s public campaign truly paid off when his fine was cut to $1.2 million in 2016, down 99.9% from the original $6.7 billion. Today, he works in IT, while continuing to fight to clear his name and challenging the financial establishment.

Kweku Adoboli - UBS's $2.3 Billion Man

Rogue trader Kweku Adoboli is flanked by police officers as he leaves London court

In 2011, Kweku Adoboli, a trader at Swiss bank UBS, made headlines when his unauthorized trades led to a staggering $2.3 billion loss. The scandal shook the financial world and exposed deep flaws in the bank's risk management system.

Adoboli, a whiz-kid trader, circumvented UBS's risk controls by concocting fictitious trades and creating a hidden "umbrella" slush fund. He went all-in on the market, trading wildly on exchange-traded funds (ETFs) and taking massive bets on market fluctuations, using complex delta-one strategies. Adoboli engaged in "forward settling," a practice of booking future trades to offset current losses, to buy time and conceal his unauthorized activities. The scheme unraveled when he failed to explain the discrepancies in his trading records.

Adoboli didn't flee, but the law was swift to catch up with him. The trader’s last-ditch effort to cover his tracks by fabricating an email trail of non-existent trades was unsuccessful. He was arrested in his luxurious London home and charged with fraud and false accounting. After a dramatic trial, Adoboli was sentenced to seven years in prison. He served half his sentence before being released in 2015. In a bitter twist, Adoboli was deported to Ghana, the country of his birth, in 2018. Today, he shares his cautionary tale as a public speaker and advocates for a more ethical approach to finance.

Yasuo Hamanaka - Sumitomo Corporation's Copper King

"Mr. Five Percent" on the phone by his desk in Tokyo

The notorious "Copper King," Yasuo Hamanaka, shook the global commodities market with his elaborate scheme that saw him control more than 5% of the global copper supply. As the head of copper trading at Sumitomo Corporation, one of Japan's most prestigious trading houses, Hamanaka manipulated the copper market for over a decade, amassing a staggering $2.6 billion in losses.

Hamanaka's elaborate scheme involved cornering the global copper market through a combination of unauthorized trades and off-the-books loans, forging his supervisors' signatures to secure these loans. By hoarding copper and creating artificial shortages, Hamanaka manipulated prices, driving them up and profiting from the inflated market. The scheme came to light when Sumitomo Corporation discovered a series of unauthorized transactions, leading to an in-depth investigation that revealed the extent of Hamanaka's manipulation.

Unlike other rogue traders, Hamanaka's flight was short-lived. He was arrested in Tokyo and charged with forgery and fraud. After a hasty trial, the Copper King was sentenced to eight years in prison. Hamanaka served his time and was released in 2005, slipping quietly into obscurity.

John Rusnak - Allfirst Financial's Currency Cowboy

John Rusnak giving an interview shortly after being sued by his previous employer

John Rusnak giving an interview shortly after being sued by his previous employer

In 2002, John Rusnak, a currency trader at Allfirst Financial, a subsidiary of Ireland's Allied Irish Banks (AIB), shocked the industry when his unauthorized trades resulted in a staggering $691 million loss. The scandal left the banking world reeling and raised serious questions about risk management in the foreign exchange market.

Rusnak, a high-flying forex trader, employed a "martingale" strategy – doubling down on losing bets in the hope of an eventual win. He falsified documents and hid losses behind a smokescreen of bogus options trades. In particular, he masked his trades in currency pairs like USD/JPY and EUR/USD, using complex derivatives and options contracts. When his strategy went belly up, Allfirst and AIB were left to face the music.

Rusnak didn't try to run, but the consequences of his actions caught up with him quickly. He was arrested and charged with bank fraud. In a surprising twist, Rusnak cooperated with the authorities, leading to a reduced sentence of seven and a half years in prison. He served six years before being released in 2009. Today, Rusnak lives a quiet life, staying far away from the financial limelight.

As the curtain falls on these enthralling tales of rogue traders, it becomes evident that their escapades have had a lasting impact on the financial landscape. While their actions were undoubtedly destructive, they inadvertently contributed to the evolution of risk management practices and the strengthening of regulatory frameworks. As financial institutions continue to learn from the lessons of the past, these rogue traders serve as a stark reminder of the importance of vigilance, transparency, and ethical conduct in the world of finance.